The purpose of this blog entry is to inform readers (some of whom may already know some of the items) of certain matters relating to Tax Court practice.

1. Documents available Online in the DAWSON System. First,

there is no permanent link for opinions. Those wanting opinions or orders have

to do so in the following alternative manners:

a. the “Today’s Opinions” or “Today’s Orders” pages, here and here, respectively which are available only on day of publication);

b. through the Docket Entries for the specific Case, here.

c. through the Opinion Search here or Order Search here. In addition to specific opinion searches, the Opinion Search offers significant database search possibilities by types of opinions (T.C., Memorandum, Summary, and Bench), by Tax Court Judge, and by dates (this latter permitting a search for cases that are no longer on the Today’s Opinions discussed in paragraph 1.a.)

I am not sure precisely why there are no permanent links provided for opinions, although I understand it relates to the design of the DAWSON system.

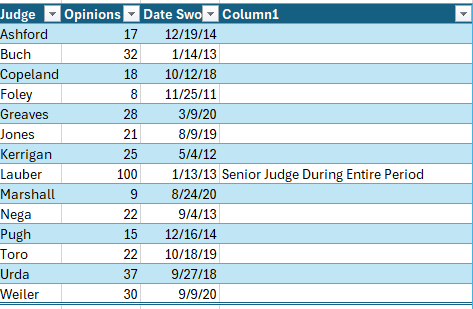

As to search by Judge with no other limiting parameters, the pages display only “first 100 matches;” in theory, this might limit the usefulness for certain types of studies. But within those parameters, certain analyses may be made. For example, having too much time on my hand, I wanted to see how productive the Active Judges were in terms of their T.C. and Memorandum Opinions. I started with a prolific generator of opinions, Judge Lauber who, although a Senior Judge since January 1, 2020, produced 100 T.C. and Memorandum Opinions from 7/26/21 (the earliest date that the search reached the maximum 100 opinions for Judge Lauber) to present (5/9/24). I then used the tool to determine the number of opinions rendered by the presently active Judges during the same period. Here are the results:

Those are the raw data; I draw no conclusions from these data because I am sure there is a lot of nuance behind them.

2. The DAWSON System makes available the dockets (except those under seal) and describes docket entries (except those identified as sealed), but provides links to the underlying document only for certain documents such as opinions and orders entered by the Court. In addition the following documents may be linked in the docket entries:

a. Court decisions (equivalent of district court judgment), but stipulated decisions are available presently if entered on or after August 1, 2023. I understand that the concern is addressed to taxpayer privacy information that previously was included in agreed or stipulated decisions (See Tax Court Rule 23(a)(4) and explanation thereof here.

b. Post-trial briefs are linked under the following parameters: (1) post-trial briefs (2) filed electronically (3) by a practitioner (4) on or after August 1, 2023. This parameter also relates to the potential for earlier briefs including private information. Briefs filed by pro se taxpayers are not publicly available on the DAWSON system; I understand that the limitation relates to the possibility of private taxpayer information being included.

c. Amicus Briefs filed on or after August 1, 2023.

Of course, all publicly filed documents not under seal can be viewed at the Tax Court’s clerk’s office. I don’t know whether any attempt is made to redact private information when viewing in the clerk’s office.

NON-DAWSON MATTERS

3, T.C. opinions are available in pamphlet pdf format (with local pages for reference) on a web page titled “United States Tax Court Reports: Pamphlets,” here. These are available about a month or two after original publication (as of this writing, the last is for the month of March 2023, but in the past, two months have been included in a single pdf). These are useful for local page citations. (Note the Supreme Court offers similar availability for recent opinions at its web page titled “U.S. Reports,” here, with the most recent as of this blog entry being for Volume 585 Part 1, from the 2017 Term, which is not nearly as timely as the Tax Court for T.C. opinions.) (This paragraph repeats what I said in Getting the Latest Case Citations – Supreme Court and Tax Court T.C. Opinions (4/29/24), here.

4, Tax Court adopted a Guide to Tax Court Policy and Procedure: Opinion Citation and Style Manual (1/2/22), here, (“Style Manual”).

a. I previously reported on the inconsistent usages among Tax Court Judges of the American convention for periods inside closing quotation marks. Does the Period Go Inside or Outside the End Quote? A Tax Court and Supreme Court Comparison (Federal Tax Procedure Blog 1/23/20; 1/25/20), here. I am advised that, although the issue is not addressed directly in the Style Manual, it is by indirection in the following Rule:

Section 320 Style Manuals and Guides

For matters of style that are not answered by the Bluebook, including punctuation, various resources provide guidance. Opinion drafters may need to consult multiple resources to address discrete drafting questions. Guides include, but are not limited to, the current edition of the United States Government Publishing Office Style Manual (GPO Style Manual), The Elements of Style by Strunk & White (Strunk & White), The Chicago Manual of Style (Chicago Manual of Style), the Oxford Style Manual, and Garner’s Modern American Usage and A Dictionary of Modern Legal Usage and The Redbook: A Manual on Legal Style by Bryan A. Garner.

In my review of the Style Manual, I found the period inside the end quotation mark convention implied as follows: (i) Section 220.20.10 Example of Substitution of Words in Quoted Text (“Chief Counsel shall be the chief law officer for the Internal Revenue Service and shall perform such duties as may be prescribed by the Secretary, including [a list of duties].”) and (ii) a search on the Style Book shows 33 insides and 0 outsides.

Hence, as a result, in my anecdotal checking of recent opinions, the convention (as it were) of period inside the closing quotation mark is observed consistently. Well, at least far more consistently than in the past, as I reported in the blog entry cited above. Indeed, in my anecdotal review of 2024 opinions, I found only one opinion where inconsistency abounded. in Pascucci v. Commissioner, 2024 T.C. Memo. 2024-43, Senior Judge Gustafson had 25 insides and 16 outsides. I am advised that such variation from the convention by indirection is permitted by the following (emphasis supplied):

Section 120 Scope

These policies and procedures serve as guidance for orders and opinions, subject to the discretion of the authoring judge. These policies and procedures also should serve as guidance when issuing any other public-facing documents on behalf of the Court.

Added 5/9/24 8:30pm:

I thought I would show the anecdotal review of 2024 cases from which I drew the conclusions in the paragraph above beginning "Hence":

No comments:

Post a Comment

Comments are moderated. Jack Townsend will review and approve comments only to make sure the comments are appropriate. Although comments can be made anonymously, please identify yourself (either by real name or pseudonymn) so that, over a few comments, readers will be able to better judge whether to read the comments and respond to the comments.